Digital Transformation in Fintech: Harnessing AI and Process Automation

- by Indu Sharma

Let’s face it — handling money used to be slow, frustrating, and packed with paperwork. Whether it was applying for a loan, checking your credit score, or just opening a bank account, you probably had to deal with forms, long queues, or endless calls. But thanks to AI and process automation, those days are quickly becoming a thing of the past.

Now, you might be wondering, “What exactly is fintech AI process automation?” Or maybe, “Is this really something I need to think about?”

The short answer is yes, and this blog is here to make it all super simple. We’ll walk you through what it means, how it works, and why it’s changing the game for businesses and customers alike.

What’s the Big Deal with AI and Automation in Fintech?

Picture this: an AI system that never sleeps, never takes breaks, and constantly learns how to do things better. Combine that with automation, which takes care of repetitive tasks like clockwork, and you’ve got a powerful duo shaking up the fintech world.

We’re talking about:

- Instant approvals for loans

- Fraud alerts before anything goes wrong

- Real-time help without ever talking to a human

With AI in fintech, everything from banking to investing has become faster, smarter, and way more user-friendly.

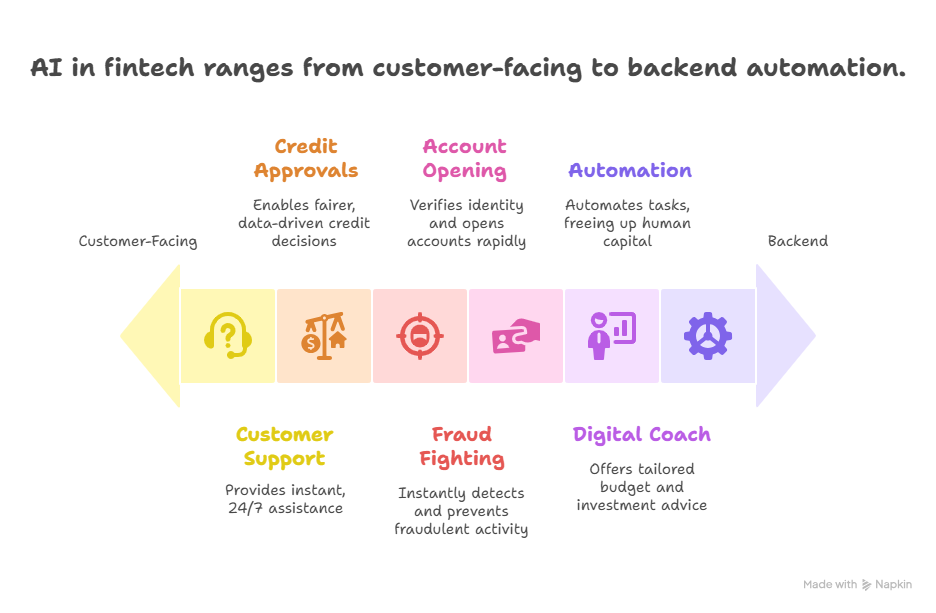

Everyday Ways AI and Automation Are Changing Fintech

Let’s break it down into everyday examples so you can see the magic for yourself.

1. Customer Support That’s Always On

Tired of waiting on hold? AI-powered chatbots are ready to answer your questions 24/7, and they get smarter the more they talk to you.

Why it matters: You get help right when you need it. Plus, human agents can focus on solving bigger problems.

2. Smarter Credit Approvals

Gone are the days when your credit score alone made or broke your loan application. AI looks at all kinds of data like rent payments or mobile bills to understand your real financial behavior.

Why it matters: More people get fair access to credit. And decisions take minutes, not days.

3. Fighting Fraud in Real Time

AI systems are trained to spot suspicious activity like a login from a new country or a sudden spending spike, and flag it instantly.

Why it matters: You’re protected from fraud before any damage is done.

4. Faster Account Opening and KYC

Opening a bank account or verifying your identity used to mean paperwork and waiting. Now, AI can scan your documents and a selfie to verify you in seconds.

Why it matters: You’re ready to go in no time, from your phone.

5. Your Own Digital Money Coach

AI-powered apps and robo-advisors help you create budgets, suggest investments, and keep you on track.

Why it matters: You make smarter money moves without needing a personal financial advisor.

6. Automation Behind the Scenes

Data entry, regulatory checks, and compliance tasks automation handles them quietly in the background, so your team doesn’t have to.

Why it matters: More time for innovation, less time fixing avoidable mistakes.

Why Fintech Companies Are All-In on AI and Automation

There are a few big reasons why fintechs are doubling down on fintech AI process automation:

- People expect lightning-fast digital service

- Automation saves money and reduces errors

- AI tightens security and compliance

- Better data means better decisions

In a world that’s moving fast, you need systems that keep up. And AI is how fintech companies are doing just that.

Chances Are, You’re Already Using It

Here are just a few examples of AI in fintech that you might be using without even realizing:

Making a payment through Paytm or Google Pay — AI checks for fraud

Investing with Groww or Zerodha — AI recommends portfolios

Getting spending alerts from your banking app — AI notices patterns

It’s not the future — it’s already here.

The Roadblocks (and How to Navigate Them)

No system is perfect, and every tech journey has challenges. But here’s how to handle the common ones:

Privacy Concerns – People are nervous about sharing financial data with machines.

Solution: Use end-to-end encryption and explain how customer data is protected.

Tech Resistance – Not everyone loves change, especially when it comes to money.

Solution: Roll out changes slowly, and make sure there’s support available for users.

Outdated Infrastructure – Legacy systems can block new tech from working well.

Solution: Bring in experts (like Value Innovation Labs) who know how to integrate AI with existing systems.

What Value Innovation Labs Can Do for You

We get it, diving into AI and automation can feel overwhelming. That’s why we’re here to guide you every step of the way.

Here’s what we offer:

- Assess your systems and spot areas for improvement

- Add AI that fits right into your current tech stack

- Automate repetitive processes to save time and money

- Strengthen compliance and security

- Build products your customers actually love

From fintech startups to growing financial platforms, we help companies work smarter and scale faster.

What’s Coming Next in AI-Driven Fintech?

Get ready, the future of AI in fintech is just getting started. Here’s what’s around the corner:

- Voice-based banking (Alexa, pay my credit card bill)

- AI that understands your habits and suggests budget changes in real time

- Smart contracts that enforce themselves automatically

- Personalized savings and investing options based on your goals

Fintech isn’t just changing, it’s evolving into something more powerful, more personal, and way more exciting.

Final Thoughts

In today’s digital-first world, people want financial services that are fast, smart, and seamless. And thanks to fintech AI process automation, that’s exactly what you can deliver.

Whether it’s protecting users from fraud, speeding up approvals, or offering smart financial advice AI helps fintechs build better experiences for customers and better results for businesses. At Value Innovation Labs, we’re here to help you bring that vision to life.

Frequently Asked Questions

Q1: Is AI safe for managing financial data?

Absolutely. With the right encryption, audits, and monitoring, AI systems are often safer than manual processes.

Q2: Can startups afford AI and automation in fintech?

Yes! Many solutions are modular and scalable. You can start small, say with automating KYC, and grow over time.

Q3: How do I begin using fintech AI process automation?

Start by listing tasks that eat up time and are prone to error. Then, talk to a tech partner like Value Innovation Labs to plan your journey.

Let’s face it — handling money used to be slow, frustrating, and packed with paperwork. Whether it was applying for…